- Billing

- Payment

- International Wire Transfer

- Form 1098-T

- Direct Deposit

Email Student Accounts at ars@northeast.edu or call (402) 844-7001.

Mailing Address:

801 East Benjamin Avenue, P.O. Box 469, Norfolk, NE 68702-0469

Fax: (402) 844-7410

Office Hours: Monday-Friday 8:00 am - 5:00 pm

As required by the Internal Revenue Service (IRS), Form 1098-T is mailed by January 31 to all students who paid for qualified tuition and related educational expenses during the previous calendar year. Form 1098-T will also be available for viewing online by January 31 by logging in to your My Northeast.

How to View Form 1098-T

Login to MyNortheast

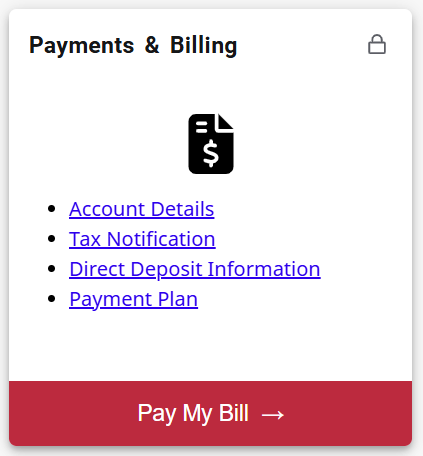

Under Payments & Billing click Tax Notification.

Select the tax year of the 1098T you would like to view.

The 1098-T form is informational only and should not be considered as tax advice. It serves to alert students that they may be eligible for federal income tax education credits such as the American Opportunity Tax Credit and the Lifetime Learning Credit as part of their Federal Income Tax Return. IRS Publication 970, "Tax Benefits for Higher Education," as well as Chapter 35 of IRS Publication 17, provide additional information on these credits. While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all of the information needed to claim a tax credit. To determine the amount of qualified tuition and fees paid, and the amount of scholarships and grants received, a taxpayer should use their own financial records. There is no IRS requirement that you must claim the tuition and fees deduction or an education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

Disclaimer

Northeast is not qualified to provide legal and/or tax advice. The information provided, may or may not reflect recent revisions in IRS regulations. For tax advice on your specific situation, contact a tax professional. For additional information regarding the tax benefits for education, call the IRS at 1-800-829-1040, or refer to IRS Form 970, "Tax Benefits for Higher Education".